Cross-Channel Marketing Using Mobile Payment Data

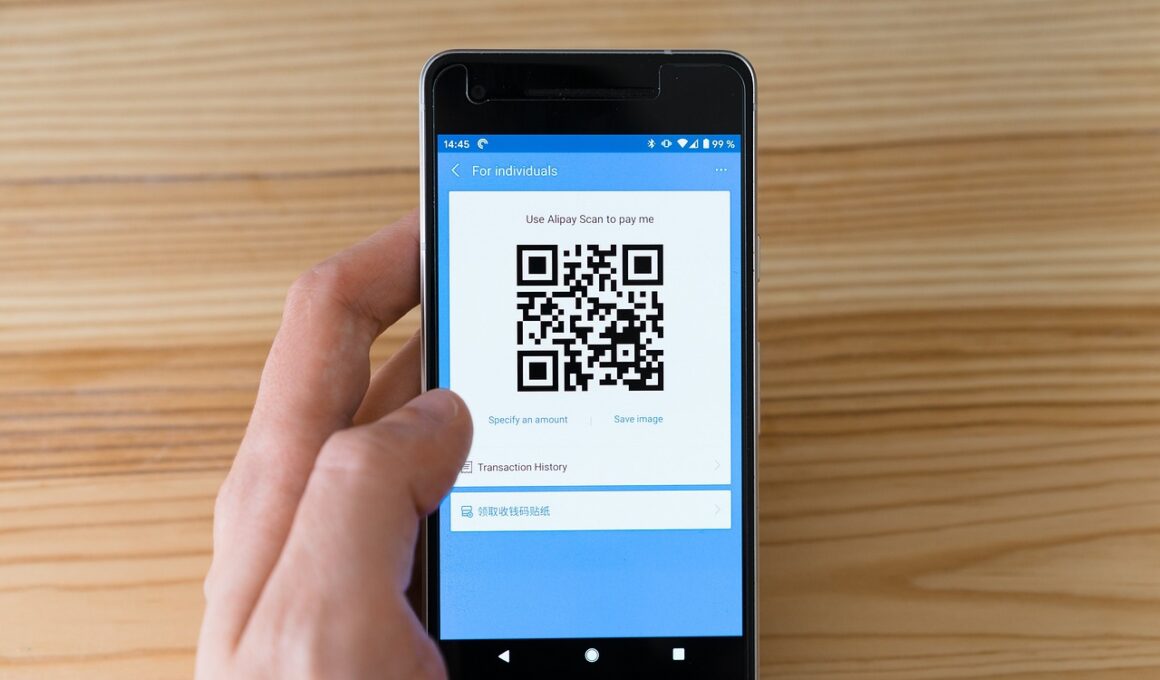

In today’s rapidly evolving digital landscape, mobile payment marketing emerges as a powerful tool to reach audiences effectively. Leveraging mobile payment data allows marketers to create targeted campaigns that resonate with consumers on different platforms. Numerous mobile payment platforms are available, such as Apple Pay, Google Pay, and others, enabling seamless transactions. These platforms provide invaluable consumer insights, including spending patterns and preferences. Integrating mobile payment marketing with cross-channel strategies enhances engagement, allowing businesses to connect with customers through multiple touchpoints. As consumers adopt mobile payment systems, their expectations also shift, demanding personalized experiences. Therefore, marketers must adapt their strategies accordingly to meet these evolving consumer needs. Establishing a cohesive marketing approach utilizing mobile payment data can yield significant results. Combining traditional advertising methods with digital tactics creates opportunities for brand storytelling and customer interaction. The integration fosters loyalty and drives conversions by delivering relevant content to the right audience at the right time. Thus, businesses must prioritize mobile payment marketing to stay competitive and connected in a saturated market.

The Importance of Data Privacy

While harnessing mobile payment data for marketing, it is essential to prioritize data privacy and security. Consumers are increasingly concerned about how their personal information is being used, which is a significant factor affecting their purchasing decisions. Transparency in data collection practices builds trust with consumers and enhances brand reputation. Marketers should align their strategies with established privacy regulations, such as GDPR and CCPA, to achieve compliance while maximizing the effectiveness of their campaigns. Businesses must communicate their data usage clearly, ensuring consumers understand the benefits of sharing information. Educating consumers about their rights and choices can foster a positive relationship between brands and customers. To safeguard sensitive information, companies should implement robust technological measures. Data encryption and secure storage are vital practices that safeguard consumer data during transactions. Additionally, continuing to monitor security systems and regularly updating protocols can prevent potential breaches and build customer confidence. By addressing data privacy thoroughly, marketers can further leverage mobile payment data while maintaining consumer trust, crucial for long-term success.

Incorporating artificial intelligence (AI) into mobile payment marketing strategies can revolutionize consumer engagement. AI-driven tools analyze extensive data sets to identify patterns and preferences, leading to tailored content that resonates with target audiences. These technologies enhance user experiences by predicting consumer behavior and providing relevant product recommendations. With AI, marketers can perform better customer segmentation, resulting in highly targeted campaigns that convert. Employing chatbots for instant customer support during mobile transactions can also enhance overall satisfaction. Consumers greatly value timely assistance, and chatbots can answer queries efficiently, driving loyalty. Furthermore, AI tools allow for real-time campaign adjustments based on performance, enhancing flexibility and responsiveness. Integrating AI further enables brands to tap into predictive analytics, optimizing future marketing initiatives. By anticipating consumer needs, marketers can foster long-lasting relationships and create memorable customer experiences. Mobile payment platforms equipped with advanced AI capabilities empower brands to navigate market complexity swiftly. As a result, organizations committed to innovation will likely gain a competitive edge over rivals. Thus, implementing AI solutions is beneficial for switching from a traditional campaign approach.

Enhancing Customer Engagement

Engaging customers using mobile payment data requires a multifaceted approach focused on personalization. Utilizing collected data enables marketers to craft tailored messages that directly address consumer preferences and behaviors. To enhance engagement, businesses can implement loyalty programs rewarding repeat customers. Such initiatives encourage consumers to continue utilizing specific payment methods and strengthen brand loyalty. Furthermore, targeted promotions and discounts can be offered based on transaction history, heightening the chances of conversion. Businesses can also leverage geolocation data to provide location-based marketing initiatives. By sending tailored offers based on a user’s geographical location, firms can drive sales during peak traffic periods. Ensuring seamless user experiences during transactions serves as a critical factor in customer satisfaction. Providing multiple payment options, transparency regarding fees, and a secure checkout process can significantly increase customer retention rates. Businesses that successfully create a frictionless experience are more likely to see increased repeat purchases. Encouraging user feedback and engagement can also provide invaluable insights to strengthen future strategies. As a powerful driver of successful campaigns, effective engagement fosters lasting connections with consumers.

Cross-channel marketing using mobile payment data not only improves customer experiences but also helps marketers measure campaign performance more accurately. Knowing where and how consumers interact with brands allows companies to optimize their strategies accordingly. Various metrics can be tracked, including conversion rates, return on investment, and customer acquisition costs, all of which inform better decision-making. By utilizing analytics tools, businesses can evaluate which channels yield the highest engagement and adjust their budgets accordingly. Moreover, integrating mobile payment solutions with existing customer relationship management (CRM) systems enables a comprehensive view of the customer journey. This holistic approach not only facilitates understanding consumer behavior but also identifies areas for improvement. Marketers should regularly analyze performance data and derive actionable insights from the findings. Insights gained from data drive iterative improvements, leading to more effective campaigns in the future. Additionally, conducting A/B testing on different campaign strategies allows marketers to pinpoint what resonates best with their audience. Ultimately, constant evaluations will help refine marketing tactics and enhance brand affinity.

The Role of Social Media

Social media plays a crucial role in driving mobile payment marketing effectiveness. Consumers frequently use social media platforms for product discovery and research, therefore marketing efforts should mirror this behavior. Creating engaging content, such as videos or interactive posts, can capture audience attention and generate organic reach. Additionally, partnering with influencers can help amplify marketing messages, bridging the gap between brands and potential customers. Influencers lend credibility and trustworthiness to brands, making their promotions more impactful. Brands should engage in conversations on social media and respond promptly to customer inquiries or feedback to foster positive relationships. Running exclusive social media campaigns can incentivize direct purchases through mobile payment methods. Creating urgency with limited-time offers encourages users to act quickly. Additionally, integrating social sharing options into mobile payment processes increases brand visibility and encourages word-of-mouth marketing. Encouraging customers to share their experiences leads to organic growth and builds brand community. Ensuring that social media channels align with mobile payment marketing goals is essential for comprehensive success. Continuous monitoring of social engagement metrics allows marketers to adjust tactics for optimal results.

As mobile payment trends continue to evolve, it is essential for marketers to stay updated on emerging technologies. Staying informed about new payment solutions and consumer preferences enables brands to adapt quickly. Innovations such as cryptocurrency and digital wallets are changing the landscape of mobile payments, and understanding these developments can provide competitive advantages. Marketers should attend industry conferences and webinars to learn best practices and network with peers. Collaboration with tech professionals aids in implementation and maximizing mobile payment features effectively. Additionally, continuous professional development in digital marketing strategies allows businesses to refine their approach regularly. Embracing agility in marketing practices enables brands to pivot strategies based on real-time data and sentiments. Look for partnerships with tech companies to enhance mobile payment capabilities further. By embracing a culture of innovation and collaboration, brands unlock unparalleled opportunities in mobile payment marketing. Aiming to be early adopters of emerging technologies while maintaining a customer-centric viewpoint allows for sustainable growth. As a collective effort, the focus on innovation can ultimately reshape the future of marketing.

Conclusion

In conclusion, cross-channel marketing using mobile payment data is a potent strategy to enhance customer engagement and drive business growth. By prioritizing data privacy while leveraging consumer insights, marketers can craft personalized experiences that resonate with their target audiences. Integrating AI and social media strategies leads to optimized campaigns that deliver measurable results. Continuous evaluation of marketing strategies and staying updated on industry trends equips businesses with the tools needed to adapt successfully. Ultimately, embracing innovation fosters long-lasting consumer relationships and helps brands achieve their marketing goals. Marketers should focus on building cohesive strategies that intertwine mobile payments with their overall marketing efforts. This comprehensive approach allows for efficient resource allocation and maximizes touchpoints with consumers. By prioritizing customer satisfaction and anticipating future needs, brands can secure their place in a competitive market environment. The potential of mobile payment data within cross-channel marketing is vast, and businesses must recognize the importance of adapting accordingly. In this dynamic environment, companies that innovate and maintain a customer-centric focus will find greater success and growth.