Mobile Payment Solutions for Seamless Event Experiences

Mobile payment solutions have transformed the way we approach transactions at events. One significant advantage is the speed of transactions, which greatly enhances attendee experience. When utilizing mobile payment platforms, attendees can enjoy faster service at vendors without the hassle of cash. Furthermore, this technology allows for greater flexibility and convenience, enabling users to pay via their smartphones or devices seamlessly. Additionally, many mobile payment systems integrate features enabling organizers to track sales data in real-time. Such data insights facilitate better decision-making about future events based on attendee preferences. Moreover, enhanced security measures are implemented through mobile payment solutions, ensuring sensitive data remains protected from breaches. Event organizers can also capitalize on promotional offers since many payment systems allow integration with marketing tools. These can boost engagement and encourage spending. For instance, discounts or loyalty rewards can be seamlessly applied at checkout when attendees use specific payment methods. Overall, mobile payment solutions not only streamline the payment process but also enhance the overall experience for all stakeholders involved in the event.

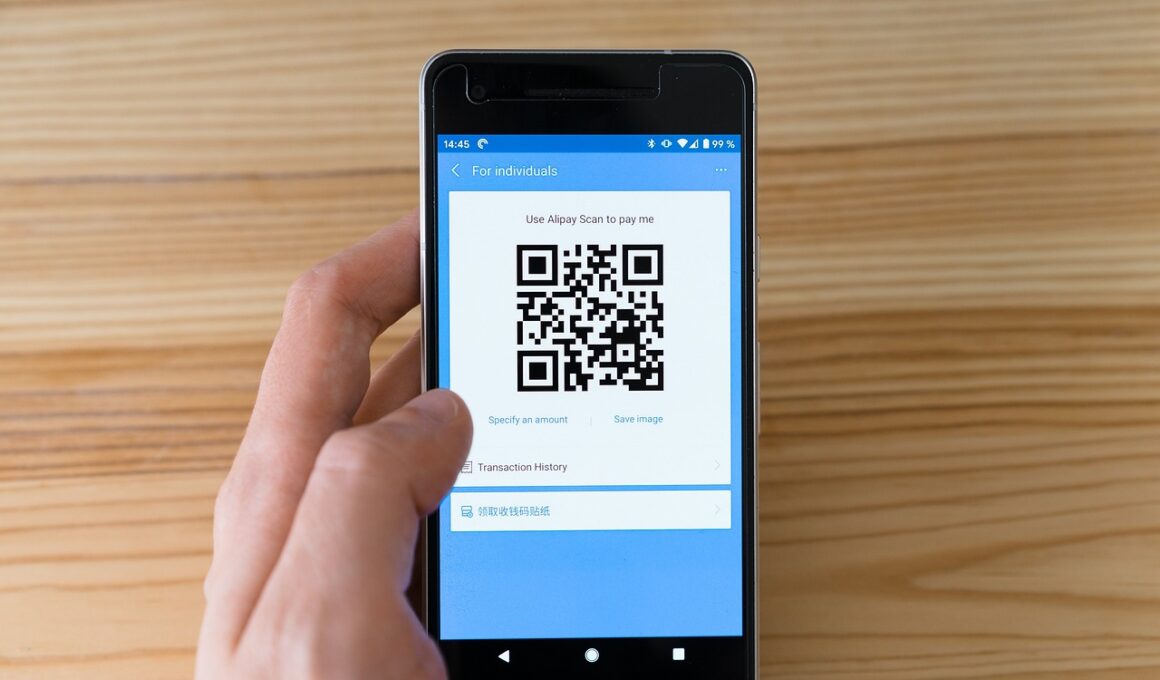

In addition to the advantages mentioned, mobile payment solutions also support contactless payments, which have gained increasing popularity. This technology allows attendees to conduct transactions quickly and safely without the need for physical touching of devices. Such safety measures have become especially important in settings with ongoing health concerns, emphasizing convenience and hygiene. Naturally, integrating contactless payment systems can increase overall customer satisfaction and encourage higher transaction volumes at events. Furthermore, the ease of setup and use of these platforms can reduce wait times for attendees and improve vendor operations. Event planners can adopt a range of payment options, including credit cards, digital wallets, and even cryptocurrency, reflecting the diverse preferences of attendees. This flexibility appeals to a broader audience, catering to varying financial habits and needs. Moreover, backend analytics from these systems provide valuable insights into attendee demographics and spending habits, advantageous for future marketing strategies. The data gathered can inform targeted approaches, enabling more personalized marketing. This direct engagement with attendees enhances brand loyalty and makes future events more appealing. Therefore, mobile payment solutions significantly influence overall event success.

Integration with Event Management Tools

Linking mobile payment solutions with event management tools creates a holistic approach to managing events. These integrated systems streamline ticketing, attendee registration, and on-site payment processes. This interconnectedness not only increases efficiency but also reduces potential errors during transactions. By utilizing all-in-one solutions, event organizers can maintain a consistent user experience from ticket purchase to the event day. Additionally, real-time reporting features enable instant financial tracking, crucial for managing budgets effectively. Organizers can assess the financial performance of the event while monitoring cash flow efficiently. Real-time data allows rapid responses to any discrepancies, helping to ensure financial accuracy. Furthermore, these integrated solutions facilitate easy reconciliation after the event. This unified system assists in maintaining a clear financial balance sheet, showcasing profit and loss effectively. Furthermore, by aligning marketing tools with payment systems, organizers can create strategic campaigns targeting attendees based on their purchase patterns. This analysis not only enhances engagement but may also increase sales through tailored promotions. As a result, event experiences become more cohesive, combining property management with customer satisfaction, thereby driving overall success.

Moreover, implementing mobile payment solutions offers a sustainable alternative to traditional payment methods. With fewer cash transactions, excess paper waste is reduced, contributing positively to environmental efforts. Utilizing technology not only enhances event experiences but also aligns with environmentally friendly practices. This appeal to sustainability resonates well with modern consumers, especially younger demographics who prioritize eco-conscious choices. Event organizers can market their events as sustainable by adopting cashless payment methods, enhancing brand reputation. Furthermore, mobile payments can enhance the overall experience through real-time updates and notifications. For instance, organizers can send messages regarding payment confirmations, special promotions, or last-minute changes, ensuring attendees stay informed. Automated processes also eliminate the need for manual handling of cash, helping vendors focus more on customer service. While traditional methods have significant applications, today’s event environments benefit enormously from mobile payment technologies. Thus, the shift towards mobile solutions genuinely reflects a paradigm shift in consumer payment preferences. Through regular feedback and technology upgrades, event organizers can continually improve user experience and further leverage these payment platforms.

Enhancing Attendee Engagement

Engagement significantly improves when events utilize mobile payment solutions. Convenient, quick transactions enable attendees to focus on event activities rather than worrying about payment tasks. This ease reduces stress and enhances satisfaction, leading to better retention rates for future events. Marketers can effectively use mobile payment platforms to encourage attendees to interact with various booths and experiences, increasing overall enjoyment. Moreover, utilizing integrated loyalty programs within these payments can incentivize return attendance. Such rewards create an engaging atmosphere for attendees, as they receive special perks or discounts based on their spending. The social aspect of payment solutions, such as sharing or gifting tickets, encourages interaction among attendees during events. Furthermore, users can easily invite friends through social media platforms or messaging services, generating buzz and excitement around upcoming events. Increased attendee engagement also results in positive online feedback and ratings post-event, allowing organizers to implement improvements for future gatherings. Therefore, mobile payments are not merely about transactions; they strategically promote excitement and community at events, ultimately contributing to enhanced satisfaction and loyalty among attendees.

Security remains a paramount concern in the landscape of mobile payment solutions. Attendees want confidence that their personal and financial information is protected throughout the transaction process. Fortunately, mobile payment providers prioritize robust security measures to safeguard customer data. For example, many platforms employ encryption protocols that protect sensitive information from unauthorized access. Tokenization, another prominent security strategy, replaces sensitive details with non-sensitive equivalents, further enhancing protection. Additionally, multi-factor authentication adds an extra layer of security, ensuring transactions are authorized appropriately. Therefore, attendees may feel more secure opting for mobile payments at events, knowing that such protective measures are in place. Furthermore, the reputation of payment providers also impacts user trust; working with well-known brands in the industry ensures reliability. Event organizers should choose reputable payment solutions familiar to their audience for optimal acceptance. Consistent reviews and quality support from payment providers ensure that any arising issues can be swiftly addressed, maintaining attendee trust. As security measures evolve, mobile payment platforms continuously advance, ensuring that concerns regarding safety are alleviated, promoting wider adoption for transactions.

Future Trends in Mobile Event Payments

Looking ahead, the landscape of mobile payment solutions for events is set for significant evolution. One emerging trend is the rise of artificial intelligence and machine learning technologies, which can further personalize attendee experiences. Such technologies allow event organizers to analyze vast amounts of data, leading to smarter, data-driven decisions. These predictive analytics can help create tailored marketing campaigns based on individual spending habits and preferences, improving engagement rates. Additionally, blockchain technology is poised to streamline mobile payments further, offering heightened security and transparency in transactions. These advancements will undoubtedly contribute to faster transaction speeds and lower fees for vendors and attendees. Furthermore, integration of virtual and augmented reality experiences within mobile payment systems presents exciting prospects for immersive events. Attendees may soon pay for unique experiences or merchandise through smooth interactive platforms utilizing VR or AR technologies. As consumer habits evolve, mobile payment systems must adapt to meet new demands, ensuring convenience and efficiency at every stage. In conclusion, the future of mobile payment solutions in event marketing seems bright, promising enhanced experiences and increased attendee satisfaction.

In summary, mobile payment solutions have become immensely valuable tools for the event marketing industry. They dramatically shorten transaction times, enhance attendee satisfaction, and ensure secure payment processes. As the trend continues to evolve, more event organizers must consider integrating these technologies into their operations. Their ability to streamline various aspects of attendee engagement leads not only to improved customer experiences, but also to increased revenue for vendors. Combining these payment solutions with effective data analyses allows a better understanding of attendee preferences, vital for creating personalized marketing strategies for future events. As technology progresses, those who embrace mobile payments will be positioned at the forefront of event management innovation. Using technological advancements can elevate the overall guest experience, making for unforgettable events. Moreover, these solutions facilitate a shift towards sustainability, a priority many attendees now demand. With the shift in consumer preferences, cashless transactions will likely take precedence in future event planning. Enhancing attendee engagement through mobile payments leads to stronger brand loyalty and repeat attendance at future events. This comprehensive approach sets the stage for success in a highly competitive event marketing landscape.