Investor Relations and Brand Reputation Management

Investor relations (IR) is a critical practice within public relations aimed at fostering meaningful relationships between firms and their investors. This facet emphasizes transparent communication, ensuring stakeholders are well-informed about company performance and strategies. Strong IR helps bolster brand reputation, an essential element for sustained business success. Effective investor relations practice requires knowledge of financial markets and the ability to convey complex information succinctly. Creating a consistent narrative about the company’s financial health allows investors to build confidence. Companies can utilize a multitude of communication channels, such as press releases, investor webinars, and social media platforms to reach their audience. This multifaceted approach can create a more engaged and informed investor base. Furthermore, regular updates and proactive engagement can mitigate negative sentiment during challenging times. This holistic strategy underscores the importance of perception management in today’s global market. Ultimately, integrating brand messaging with investor relations enhances trust and catalyzes long-term growth, improving overall corporate health. In times of crisis, effective communication becomes even more essential, guiding perceptions and maintaining investor confidence in fluctuating markets.

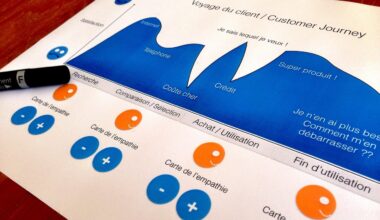

Beyond just financial metrics, investor relations emphasize storytelling. Companies must articulate their vision and long-term goals to foster loyalty from investors. This narrative should resonate with stakeholders’ values and expectations. Understanding the audience is paramount; investor segments vary widely, necessitating tailored communication approaches. Messaging should reflect diverse investor perspectives, addressing concerns associated with sustainability and corporate governance. By showcasing company efforts in these areas, organizations strengthen their reputations while increasing investor interest. Regular assessments of investor sentiment provide valuable insights into the effectiveness of communication strategies. Listening to feedback, whether through surveys or direct interactions, facilitates continuous improvement and strengthens the relationship with stakeholders. Furthermore, building a robust investor engagement platform leads to enhanced transparency, which establishes credibility. Engaging content—such as infographics detailing growth strategies and success stories—can capture attention and foster deeper understanding. Effective IR programs also include anticipating market trends and articulating how the company adapts to changing conditions. This foresight instills confidence and showcases a commitment to informed, strategic decision-making, essential against a backdrop of rapid change and competitive pressures.

Importance of Brand Reputation

Brand reputation is integral to a company’s profitability and longevity. Investors are more likely to support companies that exhibit strong reputations and ethical behavior. Companies with positive brand images often experience lower capital costs and have more opportunities to attract and retain investors. A solid reputation acts as a safeguard, particularly during economic downturns, when investor confidence can be fragile. Companies that maintain good reputations can weather crises more effectively. Reputation management involves actively monitoring public perceptions and managing stakeholder communications. Using tools such as social media monitoring and stakeholder feedback channels, companies can stay ahead of any potential issues. An organization’s ability to respond promptly and effectively can prevent negative narratives from taking root. Additionally, proactive reputation management helps identify emerging risks and opportunities, allowing organizations to pivot strategies accordingly. Transparency in operations and ethical business practices can significantly bolster reputation in investor communities. Companies that openly communicate their initiatives related to social responsibility significantly enhance their brand appeal. This process not only fosters trust but also aligns corporate goals with broader societal expectations, creating a symbiotic relationship between business success and community wellbeing.

Moreover, effective investor relations must integrate with a company’s overall public relations strategy. The alignment of messaging across different departments ensures complex narratives resonate with a broader audience. In a world where information travels quickly, consistency is key to protecting brand reputation. Discrepancies in messaging can lead to confusion and diminish trust. An integrated approach leverages all communication avenues to reinforce a company’s value proposition. Events such as earnings calls or annual meetings should showcase the company’s commitment to transparency while providing a platform for two-way dialogue. Engaging directly with investors not only informs them but also gathers valuable insights. These interactions can illuminate investor preferences and expectations, guiding future strategies. Report generation that compiling investor feedback with performance metrics enhances credibility and responsiveness. Regularly updated investor kits that clearly communicate hit goals, milestones, and challenges further demonstrate accountability. Investor relations specialists must be adept at crisis communication, skillfully managing narratives during challenging times. This preparedness contributes to a proactive culture within organizations, ensuring that investor communications fortify brand reputation, ultimately enhancing stakeholder trust and loyalty.

Strategic Communication Approaches

Strategic communication encompasses a wide array of activities aimed at managing the perception and understanding of the investor community. Companies should establish a schedule for regular communication, ensuring that investors are consistently informed about company developments. This predictability fosters a sense of stability and trust, allowing investors to make informed decisions. Using diversified formats, including newsletters or podcasts, enhances engagement and caters to different preferences. Crafting clear, concise messages that resonate with audiences can significantly impact investor sentiment. Visual aids, such as charts and graphs, can enhance comprehension of financial reports and performance metrics, making complex data accessible. Additionally, personal relationships with key investors can be cultivated through targeted outreach. In-person or virtual meetings provide opportunities for deeper engagement and mutual understanding. Thought leadership events also empower senior executives to connect with investors, showcasing transparency and commitment. Using a variety of channels ensures comprehensive outreach, maximizing touchpoints. A strategic communication approach benefits from ongoing refinement, guided by feedback and performance tracking. These considerations play an essential role in navigating contemporaneous shifts within the financial environment, aligning company goals with investor expectations, and positioning organizations for ongoing success.

Building and maintaining a robust brand reputation requires dedication and constant vigilance. Companies must consider the perceptions of all stakeholders, including the wider public and media. Proactive engagement with media platforms can amplify messages and create a unified narrative surrounding the brand. Collaborating with journalists and thought leaders may create opportunities for positive stories that enhance the corporate image. Moreover, companies need to prepare for crises, devising plans that articulate responses to potential reputational risks. This preemptive posture minimizes the likelihood of negative perceptions boiling over during challenging times. Consistent monitoring of media coverage enables companies to adjust strategies proactively. Regular evaluations of brand perception through surveys or focus groups can provide insights into stakeholder attitudes. Companies should aim for transparency in sharing both successes and challenges, as this demonstrates commitment and honesty, enhancing credibility. Crucially, aligning overall corporate social responsibility (CSR) efforts with investor relations strategies serves to strengthen both facets. When investors see that a company is committed to ethical practices and social initiatives, they are more likely to invest long-term, attesting to the interdependence of IR and brand reputation within a competitive business landscape.

Conclusion: Navigating Investor Relations

In conclusion, investor relations is a crucial aspect of public relations, with a direct impact on brand reputation. The interplay between how companies communicate with investors and how they project their brands cannot be overstated. Active engagement, transparent messaging, and systematic reputation management strategies are vital to fostering a positive investor perception. Firms must recognize that their reputation not only influences investor decisions but also shapes stakeholder relations at large. By implementing integrated strategies that encompass communication efficiencies and stakeholder expectations, organizations can build longstanding loyalty and commitment from their investor base. This dedication to transparency and dialogue can mitigate reputational risks while strengthening overall investor confidence. In an age of instant communication and increasingly vocal investors, organizations cannot afford to neglect their investor relations practices. Ultimately, the future of a business increasingly relies on its ability to cultivate trust, foster genuine engagement, and maintain a strong brand reputation. Investors are more likely to lend support to companies that not only deliver financial performance but also prioritize ethical practices and social accountability, illustrating the inseparable relationship between investor relations and brand reputation.

Through remains of focused effort, continuous assessment, and strategic communication, organizations can thrive in their investor relations initiatives. This simultaneous attention to brand reputation will not only create a solid foundation for securing investor support but also contribute to overall organizational resilience in face of future challenges. Companies that leverage their investor relations cleverly capitalize on opportunities for sustainable growth, demonstrating distinction within competitive sectors. Investors increasingly prefer to back companies that show dedication towards CSR values and transparency in operations. Therefore, aligning brand strategies with investor relations effectively articulates the organization’s ethical sensibilities which can translate to financial success. Current trends indicate that investors prefer companies demonstrating responsibility towards their communities and the environment—they increasingly reflect on how businesses impact societal welfare in their equity decisions. As such, the onus is on companies to develop robust, purpose-driven narratives that engage stakeholders beyond mere financial transactions. This mindset undoubtedly fosters a culture surrounding trust, accountability, and mutual respect between organizations and their investors, leading to enhanced brand perception and long-term loyalty. Ultimately, the art of integrating effective investor relations and strong brand reputation management will undoubtedly remain a crucial endeavor for businesses aiming to excel in the evolving corporate landscape.