The Influence of Mobile Payment Apps on Purchase Decisions

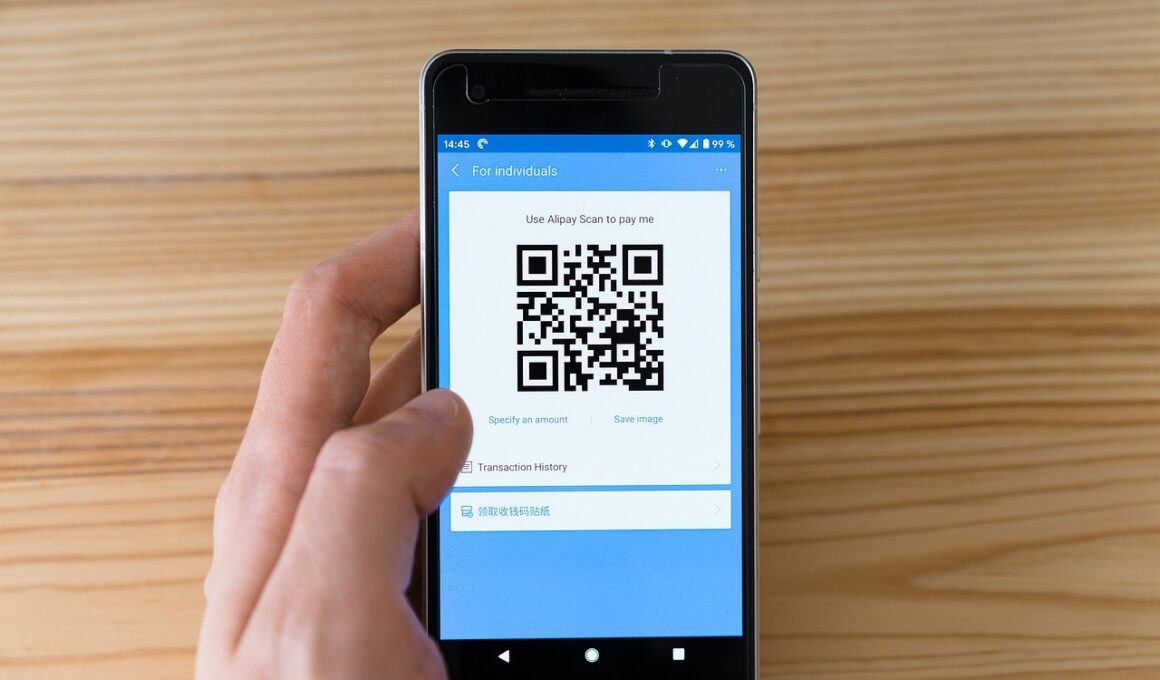

In recent years, mobile payment apps have revolutionized the way consumers make transactions. More users are opting for cashless methods, thanks to the convenience and speed offered by smartphones. These apps allow for quick payments, from groceries to online shopping, enhancing much flexibility. A significant reason for this shift is the growing reliance on technology among younger demographics. With features such as instant fund transfers and simplified checkouts, mobile payment apps are changing consumer behavior dramatically. The increase in transactions through such platforms showcases the influence these apps have on buying habits. Consumers appreciate features like loyalty rewards and discounts which these apps often promote. Additionally, users are more inclined to adopt these solutions if they perceive robust security measures are in place. Research shows that when consumers trust mobile payment systems, they are more willing to use them frequently. This insight indicates that enhancing user security and providing clear communication about it can further drive user adoption, shaping the future of shopping routines. Understanding these dynamics is crucial for marketers aiming to leverage mobile payment technology effectively.

Consumer Trust in Mobile Payments

Trust is an essential element in the contemporary marketplace, especially in mobile payments where data security is a vital concern. Users are understandably wary of sharing sensitive information through apps, leading to an essential need for strong security protocols. Successful mobile payment apps have implemented stringent security measures, including two-factor authentication and encryption, to protect user data. Such measures not only safeguard transactions but also foster trust among users. When consumers feel secure using mobile payment platforms, they frequently engage with these applications for purchases. Enhancing user experience by keeping security at the forefront enables brands to build lasting customer loyalty. Notably, consumer trust significantly influences purchase decisions; people will not engage with brands lacking transparent operational practices. Moreover, seamless navigation and clear user instructions play considerable roles in user acceptance. Marketers should focus on educating users about the security features of their mobile payment systems, effectively reducing hesitation to adopt. Ultimately, creating a safe environment through effective communication and education, while maximizing user satisfaction, can pave the way for increased consumer cooperation and market growth.

Mobile payment apps often utilize marketing strategies that encourage users to make quicker purchase decisions. One prominent strategy is personalized recommendations based on previous spending habits. By analyzing users’ transaction data, these apps can suggest products and services that align with individual preferences, making them far more appealing. This tailored approach helps capture user attention, increasing conversion rates significantly. Additionally, many applications integrate promotional offers that provide incentives for users to engage and spend. Offers like cashback, discounts, and loyalty points can trigger a purchase impulse. Users tend to respond well when they perceive they are receiving a good deal, thereby smoothing the path to completing a transaction. Integrating gamification elements like challenges or daily rewards can further enhance engagement, encouraging users to explore and utilize app features more frequently. Also, reminders about uncompleted transactions can prompt users to follow through, making mobile payment apps more effective. Marketers must focus on a blend of personalized and promotional strategies, following up with analytics to measure effectiveness, ensuring the approach resonates with users while enhancing overall satisfaction.

The Role of Social Proof

Social proof has become a powerful element influencing user behavior, particularly in the realm of mobile payment applications. Users tend to trust decisions validated by others, making reviews, testimonials, and overall ratings essential components for mobile payment apps. By showcasing high user ratings and positive feedback, brands can create a conducive environment for new users considering these platforms. Social media plays a vital role in displaying user experiences, with customer experiences shared online further enhancing brand credibility. High user engagement on social media platforms can lead to increased downloads, encouraging the adoption of these payment solutions overall. However, brands must ensure that any social proof they present is current and genuine, as users can quickly detect insincerity. Creating a community around mobile payment apps offers a unique opportunity for brands to connect with users, share tips, and foster user loyalty organically. This sense of belonging can make users more likely to prefer and advocate for the application over competitors. Marketers must leverage social proof effectively, ensuring it aligns with overall strategies and builds trust across user demographics.

Understanding consumer demographics is critical for enhancing mobile payment marketing strategies. Younger generations tend to favor mobile apps for purchasing, driven by their familiarity with technology. Marketers should prioritize targeting these consumer segments, creating tailored messaging that resonates with their preferences. As tech-savvy individuals, younger consumers are more inclined to explore innovative features such as one-click payments and real-time transaction notifications. Marketers can further enhance user engagement by developing educational content on mobile payment benefits. Users often fear the transition from traditional transactions to mobile payments due to a lack of knowledge. By providing insights into the security, speed, and convenience offered by mobile payment solutions, brands can alleviate concerns while motivating desired behaviors. Additionally, targeting the features that appeal to different age groups can help maximize user engagement. For instance, while convenience remains a priority for all age brackets, loyalty rewards might resonate more with older consumers. Identifying diverse needs within the target audience proves essential for brands aiming to develop tools that engage effectively. By understanding users’ behaviors, marketers can drive choices that enhance overall satisfaction across various demographics.

The Future of mobile payment marketing

The future of mobile payment marketing seems poised for continued evolution as technology and consumer expectations advance. New innovations such as contactless payments and augmented reality will reshape the way consumers view their shopping experiences. The integration of Artificial Intelligence (AI) into mobile payment solutions will allow for better personalization, creating a richer user experience tailored to individual preferences. A noted trend includes the rise of e-wallets and cryptocurrency, which presents unique opportunities for marketers as behaviors shift. As more consumers become comfortable with these alternatives, brands must adapt marketing strategies to align with changing preferences. Furthermore, collaboration with traditional financial institutions can lead to increased credibility for mobile payment apps, boosting user adoption. Marketers need to stay informed of emerging technologies and recognize how they can integrate these developments into existing platforms efficiently. Developing a robust strategy that accounts for future trends while maintaining a solid foundation of security and user trust will be crucial as competition increases. Ultimately, understanding consumer behavior through market research will empower brands to pioneer advancements, positioning themselves at the forefront of mobile payment solutions.

To conclude, the influence of mobile payment apps on purchase decisions is undeniable and rapidly growing. These applications provide consumers with convenience, security, and enhanced engagement, significantly impacting their buying behavior. Marketers must focus on building trust through effective security measures while simultaneously employing personalized approaches that influence user satisfaction. An understanding of the consumer landscape and social proof dynamics can foster loyalty and maximize engagement with mobile payment applications. Looking ahead, harnessing innovations and technological advancements will be essential for brands aiming to maintain relevance in a competitive market. Strategic alignment with consumer preferences ensures a successful approach to mobile payment marketing, guiding brands toward growth opportunities. With an increasing number of users relying on mobile payment solutions for transactions, the significance of targeted strategies becomes all the more profound. Balancing security with convenience, personalization with promotional tactics, ultimately positions brands to tap into a lucrative, ever-evolving market. The continued trajectory of mobile payments will further shape consumer habits, providing marketers ample opportunities to engage and influence buying behaviors effectively.

The influence of mobile payment apps on purchase decisions is significant with growing user adoption. As more transactions take place, understanding the dynamics is crucial for marketers.